do you pay capital gains tax in florida

But these arent really in the exit bracket. If youve owned the property for one year or less then it falls under the short-term capital gains tax bracket.

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

Florida does not have personal income taxes or capital gains taxes.

. A gift tax estate tax or even capital gains tax could come due. Short-term capital gains taxes are paid at the same rate as youd pay on your. Short-term capital gains tax is a tax applied to profits from selling an asset youve held for less than a year.

Do I have to pay capital gains tax. 40126 to 85525 is taxed at 22 and long-term capital gains of 15 apply. Depreciation Recapture Tax This is capped at 25 based on your ordinary income tax rate Capital Gains Tax This is either 0 15 or 20 depending on your tax filing status and your marital status.

Capital gains taxes can apply to securities think stocks and bonds and tangible assets real estate. A capital gains tax is the fee you pay on the profits made from selling an asset. Real estate for real estate in another country.

Importantly you only pay depreciation recapture tax on the amount that you have claimed while owning the property. Do I need to move back in to sell it so I can get some exemption. 3 to sell their equity.

Florida is one of the 9 states that do this. Decrease the amount of such capital gains taxes by 10 and 15 if the investment is held for five and seven years respectively. Between 9876 and 40125 is taxed at 12 with no long-term capital gains tax.

2 increasing their yearly compensation just to meet their tax burden or. Texas is one of the 9 states that do this. Florida Capital Gain Taxes.

With that said I do have sympathy for the people living in countries where you have to pay wealth tax or tax on unrealized gains which for founders means. Up to 9875 is taxed at 10 under normal rates with no long-term capital gains tax. 1 taking out loans to pay taxes.

This exemption is 1206 million as of 2022 up from 117 million in 2021. Hello I bought my house in Florida Nov 26 1994 and placed it for rent in Nov 12 1996 due to a work transfer to Guam. The main reason I want to sell it is to avoid capital gains tax and minimize my yearly land tax.

IRS Code Section 1031 will not allow the avoidance of capital gains taxes in all cases. For example the exchange of US. Rules and Regulations.

Get a full exemption from capital gains tax on all future capital gains on the invested funds if an investment is held for 10 years starting in 2018. You are stepped up to a cost basis of 400000. The time in which you owned your Idaho house is going to play a role in the type of Idaho capital gains tax you could end up being responsible for.

Capital gains tax is the tax that you pay on those capital gains. Reference 5 Because you still have incidents of ownership however and provided you live there you remain eligible for the federal 250000 capital gains exclusion 500000 if youre. You can pay the gift tax on that amount in the year you make the gift or you can apply that 183999 to your lifetime exemption.

85526 to 163300 is taxed at 24 with long term capital gain tax of 15. Therefore if you sell the house in the future for 500000 you only pay capital gains tax on 100000.

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

2021 Capital Gains Tax Rates By State Smartasset

Florida Real Estate Taxes What You Need To Know

The States With The Highest Capital Gains Tax Rates The Motley Fool

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Tax In Kentucky What You Need To Know

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses

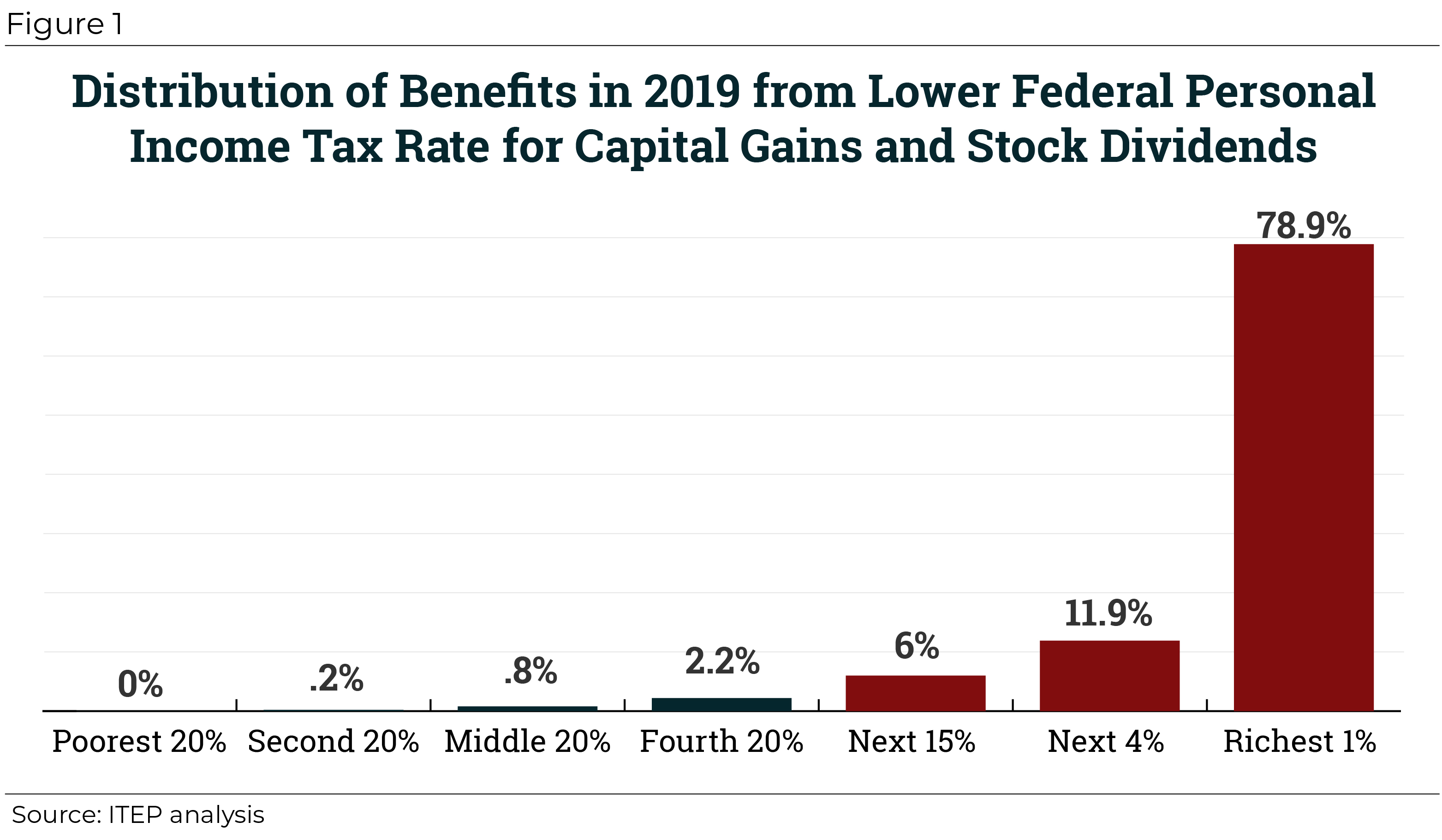

The Preferential Tax Treatment Of Capital Gains Income Should Be Curbed Not Substantially Expanded Itep

How Much Tax Will I Pay If I Flip A House New Silver

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

How High Are Capital Gains Taxes In Your State Tax Foundation