nassau county property tax rate 2020

Below is a town by town list of NJ Property tax rates in Atlantic County. The owners of the listed properties as well as applicable property managers or operators of such facilities are responsible for collecting the.

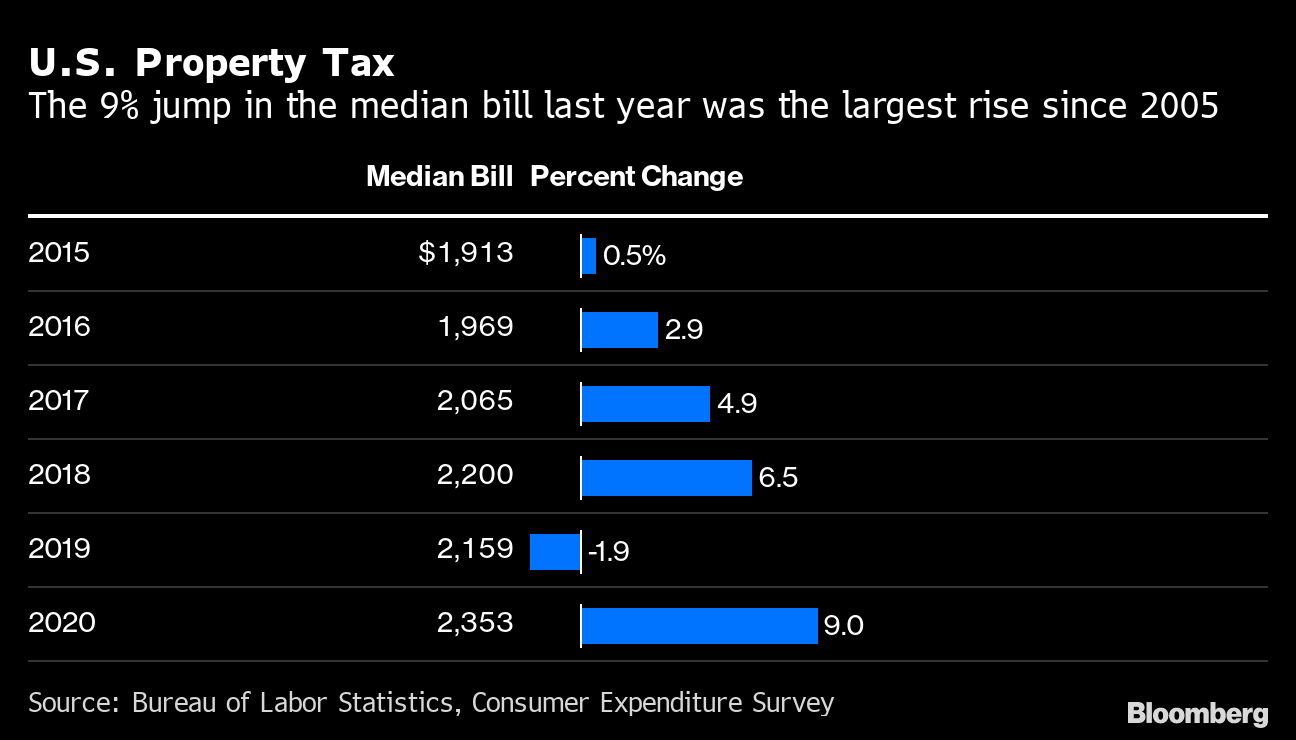

Historic Home Prices To Whack Owners In Next Year S Property Tax Bloomberg

Average Effective Property Tax Rate.

. The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800. Rate Sheet for Active Employees. State Benefits for Veterans.

Cook County has one of the highest median property taxes in the United States and is ranked 91st of the 3143 counties in order of median property taxes. If the return is not complete by 531 a 99 fee for. It is an add-on tax like the state sales tax and is collected from the tenant at the time rent or accommodation charges are collected.

Interest rates on court-ordered property tax refunds. Assessed Value x General Tax Rate100 Property Tax. Interest rate on late payment of property taxes.

Nassau County Office of Crime Victims Advocate - Brochures. Federal Benefits for Veterans. The Tourist Development Tax rate in Polk County is set at 5.

Offer valid for returns filed 512020 - 5312020. To access specific property tax programs services and information please use the Property Tax Services menu available on this page. Ad valorem taxes are.

Here are the median property tax payments and average effective tax rate by Florida county. Property taxes are levied annually on real property real estate and tangible personal property. Veterans Real Property Tax Exemptions.

Atlantic County Property Taxes. Cook County collects on average 138 of a propertys assessed fair market value as property tax. Property taxes in NJ is calculated using the formula.

The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county sales tax and a 038 special district sales tax used to fund transportation districts local attractions etc. The Nassau County Sales Tax is collected by the merchant on all qualifying. Egg Harbor City has the highest property tax rate in Atlantic County with a General Tax Rate of 5281.

Real property refers to land buildings fixtures and all other improvements to the land. What is the Florida Property Tax Rate. Corporations that have filed with the Tax Department copies of local laws or resolutions opting out of the real property tax exemption for certain energy systems.

How To Know When To Appeal Your Property Tax Assessment Bankrate

Property Taxes Polk County Tax Collector

Understanding Your Nassau County Assessment Disclosure Notice

Australia Property Investment Mernda On The Park

What Does Assessed Value Mean Rocket Mortgage

The School Tax Relief Star Program Faq Ny State Senate

Property Taxes Polk County Tax Collector

Historic Home Prices To Whack Owners In Next Year S Property Tax Bloomberg

49 Dreyer Ave Staten Island Ny 10314 Realtor Com

2022 Property Taxes By State Report Propertyshark

Justin Tyndall Justin Tyndall Twitter

Suffolk County Ny Property Tax Search And Records Propertyshark

Suffolk County Ny Property Tax Search And Records Propertyshark